April 14, 2025

Verifying someone’s identity remotely requires reliable document verification. Organizations must balance security with user experience as they choose between technologies that offer different levels of assurance and accessibility.

Document verification establishes trust and plays a critical role in the wider identity proofing process. And no small part, either – the banking sector processed around ~37 billion verifications in 2024 alone!

The most effective remote identity verification systems can adapt to changing technologies and evolving security challenges while maintaining a seamless user experience. With the right Level of Assurance (LoA) delivered at the point of verification, the strength of ongoing authentication will be enhanced, improving ROI and ultimately leading to a sustainable remote identity solution.

But let’s put it more simply: there many document verification technologies, and you must understand the options available to you before deciding which is the right choice.

As organizations navigate the transition from in-person to digital verification, two technologies have emerged as leaders:

- Optical Character Recognition (OCR)

- Near-Field Communication (NFC).

This article will explain the various types of document verification technologies, exploring their strengths and their roles in the wider identity proofing spectrum. Understanding their distinct capabilities and use cases is crucial for implementing effective identity verification systems.

Context: Document Verification’s Role in The Shifting Landscape of Identity Proofing

Before diving into document verification technologies, it’s important to understand their role in the wider identity proofing ecosystem. This typically involves three key components working in harmony:

- Database Verification: Cross-referencing user-provided information against trusted databases

- Document Verification: Validating the authenticity of government-issued identity documents

- Biometric Verification: Confirming the person asserting the identity is genuine

While database validation provides a strong supporting factor, it cannot be used alone for reliable identity verification – it’s part of a wider process, just as Know Your Customer (KYC) is a part of the wider Anti-Money Laundering (AML) process. See below:

![Document Verification Technologies: Making the Right Choice for Your Organization [Guide] 4 Image 14 04 2025 at 14.45](https://www.iproov.com/wp-content/uploads/2025/04/Image-14-04-2025-at-14.45.jpeg)

Document verification serves as a critical bridge between basic database checks and advanced biometric verification, providing a strong foundation for establishing identity trust.

The International Organization for Standardization (ISO) has established standards defining assurance levels (LoA) for identity proofing. Different regulatory frameworks adapt these levels to specific regional needs. For example, the European Union’s eIDAS regulation uses a three-level system (Low, Substantial, High) that broadly aligns with the ISO standards.

Types of Document Verification Technology: Understanding Your Options

Optical Character Recognition (OCR)

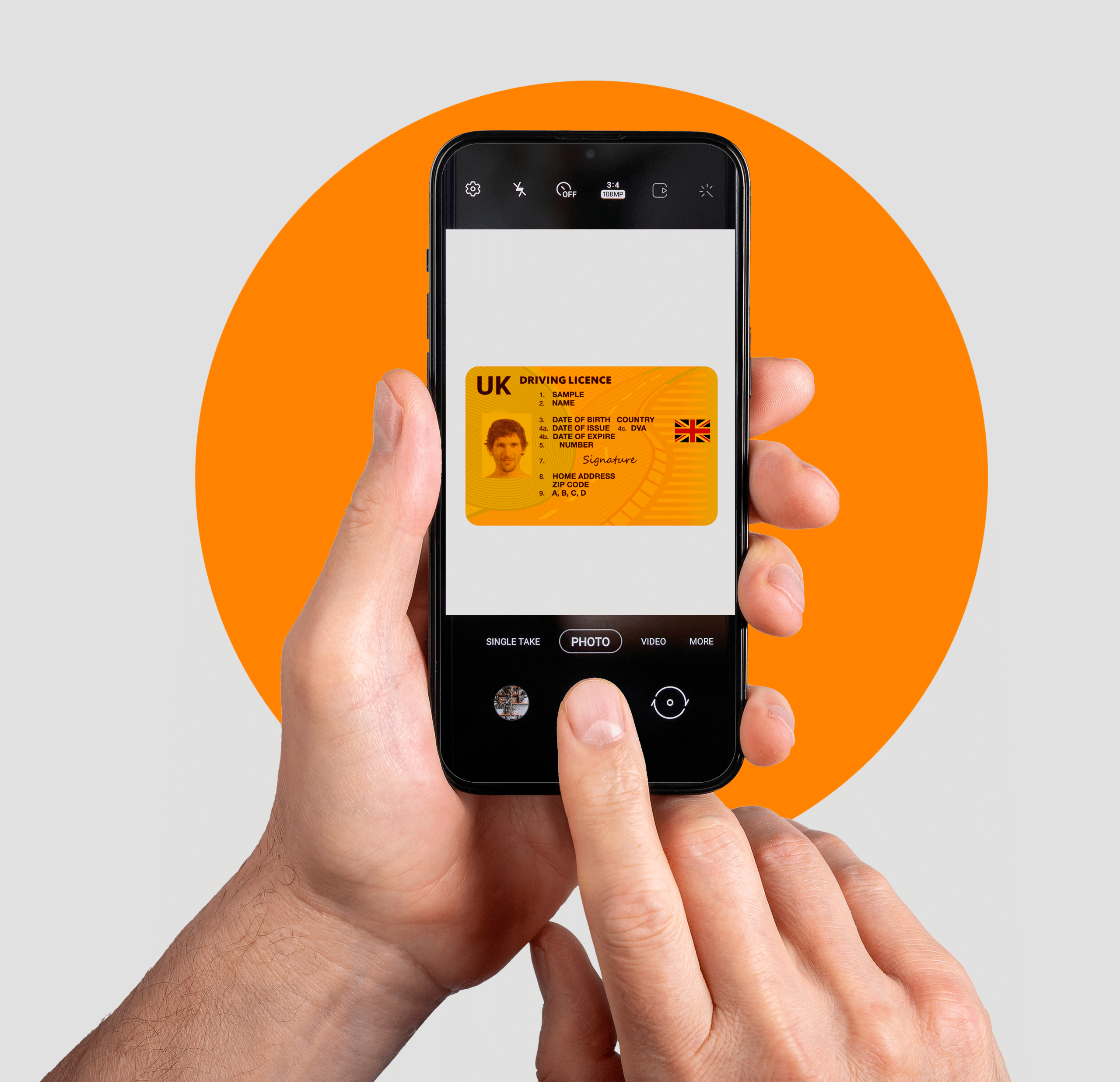

OCR technology transforms images of identity documents into machine-readable data, capturing both printed text and coded information like the Machine-Readable Zone (MRZ) found in passports.

Think of OCR as your organization’s digital librarian – efficiently extracting and cataloging information from identity documents. Using standard smartphone cameras, OCR technology transforms printed text into machine-readable data, making it both accessible and cost-effective. However, while OCR excels at data extraction, it can’t inherently verify document authenticity, making it vulnerable to sophisticated forgeries in isolation.

OCR offers:

- Universal Accessibility: Works with any smartphone camera, making it widely available to users worldwide

- Broad Document Support: Handles various ID types across jurisdictions, from driver’s licenses to national ID cards

- Real-time Processing: Provides immediate data extraction and validation, enabling quick user onboarding

- Cost-Effective Implementation: Requires minimal hardware investment from both organizations and users

Limitations include:

- Dependence on image quality and lighting conditions

- Potential for document tampering

- Cannot access encrypted chip data

- May struggle with damaged documents

Near-Field Communication (NFC)

NFC technology represents the next evolution in document verification. By reading encrypted data directly from electronic chips in select identity documents, NFC provides cryptographic security that’s highly resistant to tampering. This makes it particularly valuable for high-risk scenarios.

It offers:

- Cryptographic Security: Validates document authenticity through encrypted data, providing the highest level of assurance

- Tamper Evidence: Detects document manipulation attempts through cryptographic signatures

- Biometric Data Access: Securely retrieves stored biometric information for enhanced verification

- Standardized Format: Follows international standards for consistent data extraction

Limitations include:

- Requires NFC-capable devices

- Limited to select electronic documents

- Higher implementation costs

- Adoption varies across countries and regions, limiting global accessibility. This is subject to change as adoption inevitably increases.

Complementary Verification Methods

Several other technologies can enhance your verification strategy:

- Machine Readable Zones (MRZ) offer standardized data formats with built-in error detection, providing a reliable middle ground between accessibility and security.

- Mobile Document Verification leverages secure digital wallets and electronic IDs, combining convenience with cryptographic protection.

- Facial Biometric Verification adds an extra security layer by comparing document photos with live user selfies, helping prevent identity theft.

![Document Verification Technologies: Making the Right Choice for Your Organization [Guide] 5 Image 14 04 2025 at 14.57](https://www.iproov.com/wp-content/uploads/2025/04/Image-14-04-2025-at-14.57.jpeg)

Though not a document verification method, facial biometric verification is particularly important as it completes the verification process by confirming the person presenting the document is its legitimate owner. Modern facial biometric systems incorporate liveness detection to determine whether the biometric sample is from a live person present at the point of capture, rather than a photo, video, or mask.

Facial biometrics are considered the most accessible and convenient biometric modality, while fingerprint comparison is not widely used as fingerprints are often not present or only accessible to governments or law enforcement.

Note: NFC’s current accessibility is limited as it is not as widely available yet. But if it is an option for your organization’s user base, it’s a strong choice. Once adopted globally, NFC is pipped to be the highest in security and accessibility.

Building an Effective Verification Strategy: Risk-Based Approach

The choice of document verification technology should align with your organization’s:

Risk Profile

- High-risk use cases (financial services, government) benefit from NFC’s enhanced security

- Lower-risk applications may find OCR sufficient and more cost-effective

- You should consider fraud patterns in your industry and region

User Base Characteristics

- Consider the technological literacy and device capabilities of your target users

- Evaluate geographical distribution and local infrastructure

- Assess document types commonly used in your market:

- Are your users likely to have NFC-capable devices?

- Do they come from regions where electronic identity documents are common?

- What are their technical capabilities and preferences?

Operational Requirements

- Assessment of integration complexity with existing systems

- Evaluation of maintenance and support needs

- Cost considerations for implementation and ongoing operations

- Training requirements for staff and users

Financial services and government agencies typically require the highest security levels, making NFC verification more appropriate. Lower-risk applications might find OCR sufficient, offering a better balance of security and cost-effectiveness at a lower LoA.

Looking Ahead: The Future of Identity Verification

The document verification landscape is evolving toward reusable identity proofing and verifiable credentials. These approaches aim to:

- Eliminate repetitive identity verifications

- Allow selective disclosure of specific attributes

- Enhance privacy control for users

- Reduce reliance on central authorities

- Create interoperability across different systems and jurisdictions

Trust frameworks and digital identity ecosystems, such as the EU’s eIDAS regulation, NIST’s Digital Identity Guidelines in the US, and the Pan-Canadian Trust Framework, are establishing standardized approaches to digital identity verification. These frameworks foster trust, interoperability, and standardization while addressing privacy, security, and user rights.

The success of these systems will ultimately depend on widespread adoption and the development of trust frameworks that enable seamless, secure transactions across various sectors and jurisdictions.

Conclusion

Successful document verification requires balancing security, accessibility, and user experience. By understanding the strengths, limitations, and availability of both OCR and NFC technologies within the broader identity proofing spectrum, organizations can select the solution that best meets their specific needs while building trust in digital interactions.

The key to success lies in:

- Choosing the right document verification technology based on your organization’s unique requirements and risk profile

- Implementing a comprehensive approach that includes appropriate database checks, document verification, and biometric confirmation

- Aligning verification methods with appropriate levels of assurance

- Regular evaluation and updates to ensure your verification system remains effective against emerging threats

Learn more about document verification technologies in our Spectrum of Identity Assurance Report series, or book your consultative demo with iProov today!