November 21, 2022

Identity checks are a mandatory part of the financial onboarding process, however many of today’s consumers are reluctant to travel into a branch, join a video conference call, or answer questions about a loan they took out 10 years ago to prove that they are who they claim to be.

UBS, the largest Swiss banking institution and the largest private bank in the world, is not unlike other financial institutions in this scenario. They are constantly evaluating ways to innovate current processes to improve customer experience, but they need to ensure that improving customer experience doesn’t increase risk. One of the most common business processes that financial institutions are looking to modernize is the onboarding process. For both financial institutions and customers alike, it is often a very manual and time-consuming process that relies heavily on in-person interactions. One of the unexpected consequences of the pandemic, however, has been that customers now feel entitled to a wide range of virtual services that had traditionally been performed in person.

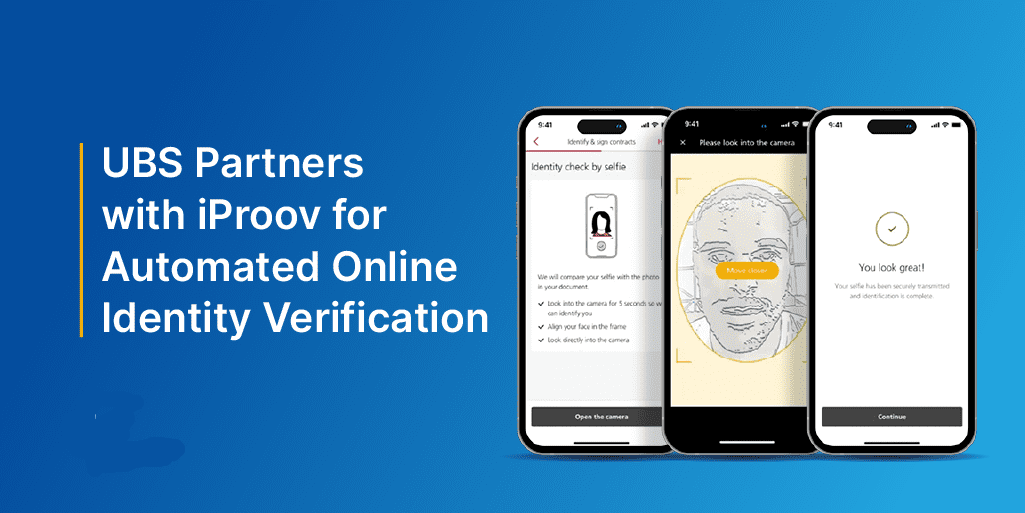

UBS has embraced this sentiment, and with iProov, is now offering a service to onboard new customers online in a secure, fast, and convenient process. With iProov, UBS customers are now able to open an account online in minutes, thanks to automated identity verification.

In May 2022, UBS launched UBS key4 for clients who want to carry out their banking transactions at any time of day, entirely digitally. UBS key4 includes personal accounts, savings accounts, debit, and other cards, mobile payment options, and more. Using iProov face verification technology, UBS key4 customers can now onboard remotely 24/7 in only 5 minutes. Clients enroll onto the service simply by scanning their face against a trusted government-issued document, such as a passport with a NFC chip. UBS is the first bank in Switzerland to offer this process for account opening in combination with qualified electronic signatures.

Prior to partnering with iProov, UBS key4 relied on using video calls to verify client identity virtually.

Why is face biometric verification a game changer for the financial services industry?

Biometric face verification enables banks and other regulated firms to securely:

- Verify that an online individual is who they claim to be, within seconds

- Confirm that an online individual is a real person and not a photo, video, or other spoof, thus protecting against identity theft and synthetic identity fraud

This modernizes the onboarding experience to provide a fully digital, fast, convenient service to users that:

- Simplifies the user experience for new and existing customers – accessing a new bank account, credit card or other service takes minutes instead of days

- Offers inclusivity – everyone has a face and no specialist hardware is required to complete a biometric face verification; all that’s needed is a user-facing camera on a device or kiosk

- Provides reassurance to customers that security checks are in place and their finances are being protected

- Protects the organization against financial loss from fraud

- Complies with KYC and other regulatory requirements

But it is important to understand that not all face verification technology is created equal. Financial institutions require the highest levels of resilience to advanced threats and many biometric verification vendors cannot deliver. iProov is different because it offers:

- Patented Flashmark technology that uses light and color to verify that a customer is the right person, a real person, and verifying in real-time

- The highest levels of security against digitally injected attacks

- Protection against evolving cyber threats, thanks to the iProov iSOC and ongoing threat management

- Passive authentication – the light and color do the work, requiring the user to simply look at their device. No complicated instructions to move or read out numbers are needed.

- Cloud-based for maximum security – iProov assumes the user’s device has been compromised

- Proven experience – iProov is used in large-scale mission-critical deployments around the world, including banks and governments such as Rabobank, ING, the U.S. Department of Homeland Security, the UK Home Office, the Australian Taxation Office, Singapore GovTech, and more.

- Outstanding accuracy and performance – iProov delivers >98% typical pass rate and 1.1 average number of attempts based on in-production results, providing customers with the smoothest, most hassle-free experience possible

Consumer demand for face biometrics as their preferred online verification and authentication method is already huge, and it’s growing. iProov’s Digital Identity Report found that:

- 55% of consumers already use biometrics to unlock their mobile devices

- 64% of mobile banking customers either already use face authentication to access their account, or would do so if it was offered – iProov enables financial institutions to make all services securely and effortlessly accessible using face verification

How does face biometric verification work for financial services providers?

Let’s imagine that a consumer wants to apply for a new financial institution’s account or credit card online. They start the application process on their smartphone, tablet, or computer and reach the stage where they need to prove their identity.

Some financial institutions might insist that the customer visits a physical location to confirm their identity and complete the application. Others might ask for an identity check via video call, where a customer service operator asks to see a customer’s ID document and checks it against their face. While others rely on knowledge-based identity checks, for example, asking the user to provide information about previous loans or mortgages, or other financial products.

Biometric face verification from iProov replaces all of the waiting, manual processing, user frustration, drop-offs, and security risks that are inherent in typical identity check methods.

Instead, the customer simply scans their trusted identity document using their smartphone, mobile device, or computer. Then they complete a brief ‘selfie’ of their face. iProov uses a simple multi-frame face scan using a sequence of colored lights to confirm that the customer is:

- The right person: The user matches the image from a trusted photo ID document or previously enrolled biometric

- A real person: Reflection of light from the skin confirms liveness and that it is a genuine human biometric, not a photo or other artifact

- Authenticating right now: The illuminated color sequence creates a one-time biometric which cannot be reused or recreated, validating the authentication is taking place in real-time

The identity verification process takes a matter of seconds and puts the customer in control of the whole journey.

Request a demo of iProov or read more about our work on biometric verification in the financial services sector.