July 7, 2023

Face authentication and verification have become ubiquitous in the lives of consumers globally. Apple Face ID, launched in 2017, has enabled millions of people to unlock their phones several times a day using a simple face scan instead of a passcode or fingerprint. These same consumers are now extending the use of facial biometrics to mobile apps, utilizing it for banking, payments, shopping, and other services. Read more about the difference between biometric face verification and face authentication here.

It’s important to note that on-device face authentication services like Face ID are useful, but they don’t provide the level of security required by banks, governments, and other organizations. Device-based authentication verifies the user only to satisfy the device itself. By contrast, iProov’s cloud-based authentication provides assurance to the organization that the user is who they claim to be, while also verifying that the user is authenticating in real-time.

Why On-Device Biometrics Fall Short

On-device biometric authentication relies entirely on the device’s integrity. If the device is compromised, the service provider has no way of detecting it, leaving room for fraudsters to exploit. That’s why secure services require cloud-based face authentication with Dynamic Liveness, which ensures real-time, tamper-proof verification.

The Comfort with Face Authentication

Millions of consumers are now very comfortable using their face for online security. But just how many people are embracing face authentication globally?

Biometric Statistics: How Many People Use Face Authentication to Access Their Mobile Banking App?

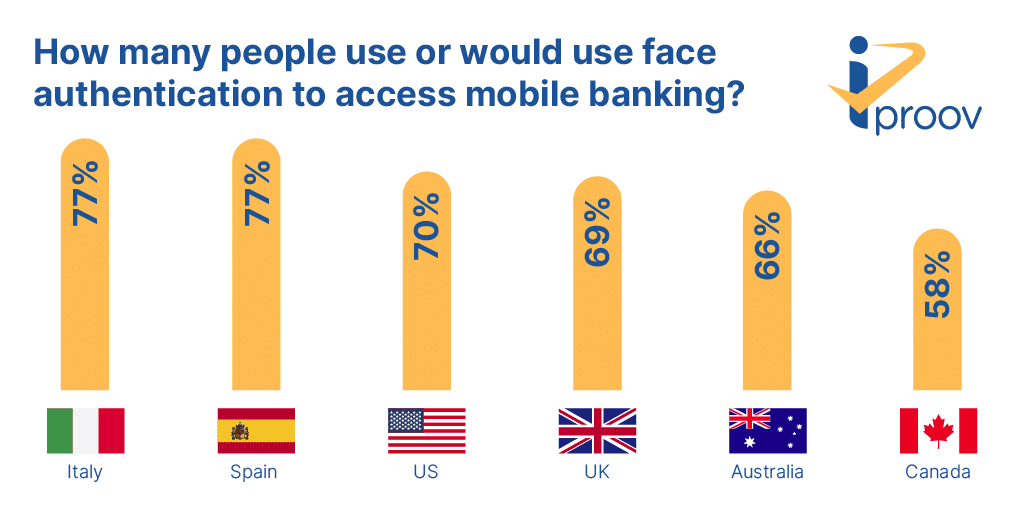

We asked 1000 consumers in the US, UK, Canada, Australia, Spain, and Italy if they currently use face authentication to access their mobile banking app on their devices.

Here’s what we found:

- 38% of respondents already use face authentication to access their mobile banking apps.

- An additional 32% would use it if given the option.

This means that 70% of respondents are either already using or are willing to use face authentication for mobile banking.

We also found that around 30% of people do all of their banking remotely on their mobile devices, meaning that a significant proportion of all banking is now accessed using facial biometric technology and highlighting the significant role facial biometrics plays in secure banking today.

The takeaway here? Consumers are comfortable using facial biometrics on their devices, and they are happy using it to access their bank accounts remotely.

The Opportunity for Banks and Businesses

For banks and other organizations, the potential is immense. By implementing secure, cloud-based face authentication with iProov, banks can enable customers to carry out high-assurance processes online, such as:

- Adding a new payee

- Transferring large sums of money

- Changing a PIN

- Requesting a debit card

This translates to reduced operational costs, fewer instances of customer frustration, and a highly secure, inclusive, and convenient mobile banking experience.

By implementing secure biometric face authentication from iProov, banks can enable customers to complete even the most secure processes online without any user frustration or drop-off caused by traditional authentication methods like passwords.

So what do people like about face authentication?

Why Do People Like Face Authentication?

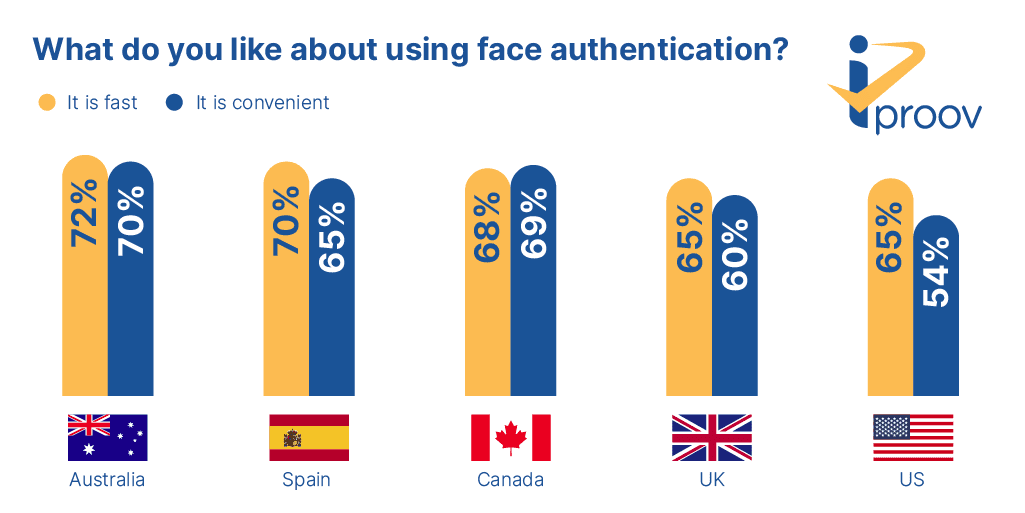

We asked people to tell us why they like using face authentication, allowing them to choose several options. Speed and convenience were the top reasons selected:

Speed

iProov’s reassuring ceremony takes just a few seconds to authenticate users. To use your phone you have to look at it, so authenticating just by looking at it requires the least effort from the user. iProov’s solution is truly passive, as there are no steps for the user to take: just look into the front-facing camera and you’re done.

Since users naturally look at their phones, authentication that requires only a glance minimizes effort.

Convenience

Face authentication eliminates the pain points associated with traditional methods:

- Passwords can be forgotten, leading to lengthy recovery processes.

- SMS one-time passcodes (OTPs) often require app-switching or even two separate devices.

Users always have their face right there — you don’t need to remember anything, carry a security token, or do anything. You just present your face to the device’s front-facing camera. Plus, there is no special hardware required, unlike with a fingerprint reader.

iProov’s Dynamic Liveness can be used on any device — including mobile devices, desktop computers, tablets, and kiosks — affording additional convenience. An important additional benefit of iProov’s cloud-based technology is that if your device is lost, stolen, damaged, or out of battery you can easily access or recover your account from any device (unlike on-device biometrics).

Earning Trust Online with Face Authentication

To summarise:

- We asked 1000 people across six countries if they use or would like to use face authentication to log in to their mobile banking app. The results ranged from 70% in the US and 69% in the UK, all the way up to 77% of people in Spain and Italy. An average of 70% of people across the six countries use or would like to use face authentication for mobile banking.

- We then asked what people liked about using face authentication. The top two answers were speed and convenience.

- iProov can help onboard, verify, and authenticate your customers using facial biometric technology. Dynamic Liveness offers the highest levels of security and user experience.

iProov is already trusted by leading organizations, such as the US Department of Homeland Security, the UK Home Office, and leading banks to deliver secure face authentication. Dynamic Liveness is crucial for organizations looking to deliver national-grade security without sacrificing the user experience.

Discover benefits of using face authentication to secure and streamline online services.

Ready to enhance your services with secure face authentication? iProov can help you onboard, verify, and authenticate your customers with confidence. Book your demo today and experience the benefits of Dynamic Liveness firsthand.